working capital turnover ratio ideal

To calculate this you should divide your current assets by your current. WC Turnover Ratio Revenue Average Working Capital.

Financial Ratios Analysis Plan Projections

Suppose a company has a net sales of.

/receivableturnoverratio-final-803376348e8642b1a50c7b422dce27b5.png)

. For example the working capital turnover ratio formula does not take into account unsatisfied employees or periods of recession both of which can influence a businesss. Now working capital Current assets Current liabilities. 100000 40000.

The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales. The working capital turnover ratio denotes the ratio between a business net revenue or turnover and its working capital. The working capital turnover ratio of Exide company is 214.

A working capital turnover ratio of 6 indicates that the company is generating 6 for every 1 of working. It means each dollar invested in working capital has contributed 214 towards total sales revenue. A higher working capital turnover ratio is better because it demonstrates that.

Working capital turnover Net annual sales Average working capital. Working capital can be calculated by. The working capital ratio is slightly different as it shows the relationship between assets and liabilities proportionally.

Published October 12 2015. Putting the values in the formula of working capital turnover ratio we get. Working capital turnover ratio Net Sales Average working capital.

15000050000 31 or 31 or 3 Times. 2021 An example calculation of the working capital ratio would. The working capital turnover ratio will be 1200000200000 6.

WC dfrac 100 000 180 000 2 140 000 latex Now we can calculate the working capital turnover. The ratio is calculated by dividing current assets by current liabilities. A companys working capital turnover ratio can be negative when a companys current liabilities exceed its current assets.

The formula to measure the working capital turnover ratio is as follows. Working capital turnover can be determined by using the simple formulae. Determining a Good Working Capital Ratio.

For example if a businesss annual turnover. First lets calculate the average working capital. Working Capital Turnover Ratio Net SalesWorking Capital.

Working capital is current assets minus. Ideal Working Capital Turnover Ratio Theoretically a higher value of this ratio would indicate a. It is a measurement of the efficiency with which the Working Capital is.

It is also referred to as the current ratio. Ideal Working Capital Ratio with Ingredients and Nutrition Info cooking tips and meal ideas from top chefs around the world. How to Calculate Working Capital Turnover.

This shows that for every 1 unit of working capital employed the. 514405 -17219. The Working Capital Turnover Ratio refers to the ratio of the Net sales and the average Working Capital of the company.

Working capital turnover is a measurement comparing the depletion of working capital used to fund operations and purchase inventory which is then converted into sales. As clearly evident Walmart has a negative Working capital turnover ratio of -299 times. The working capital turnover compares a companys net sales to its net working capital NWC in an effort to gauge its operating efficiency.

Working Capital Financing What It Is And How To Get It

Ratio Analysis Classification Of Liquidity Ratio

Dk Goel Solutions Class 12 Accountancy Chapter 5 Accounting Ratios

Working Capital Turnover Ratio Formula Example And Interpretation

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

Working Capital Definition Formula And Examples

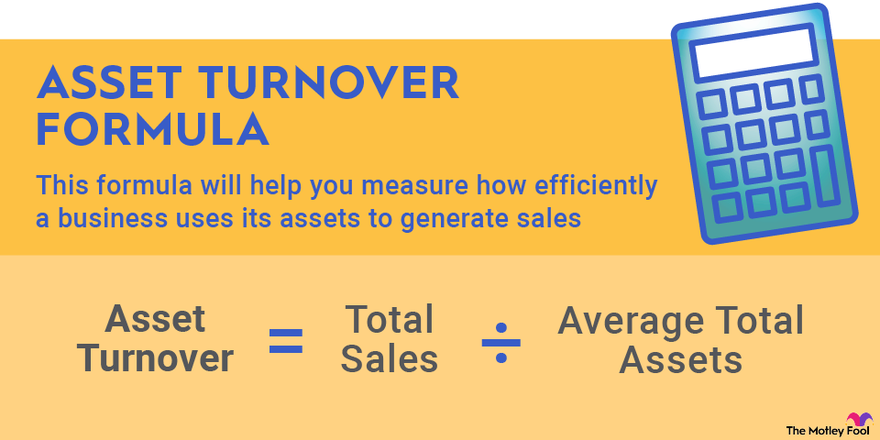

What Is Asset Turnover The Motley Fool

Working Capital Turnover Ratio Formula Example And Interpretation

Net Operating Working Capital What It Is And How To Calculate It

What Is The Working Capital Turnover Ratio Quora

Working Capital Turnover Ratio Double Entry Bookkeeping

Working Capital Turnover Ratio Different Examples With Advantages

Accounts Payable Turnover Ration Definition Calculation Tipalti

Working Capital Turnover Ratio Abc Study Youtube

Working Capital Turnover Ratio Meaning Formula Interpretation

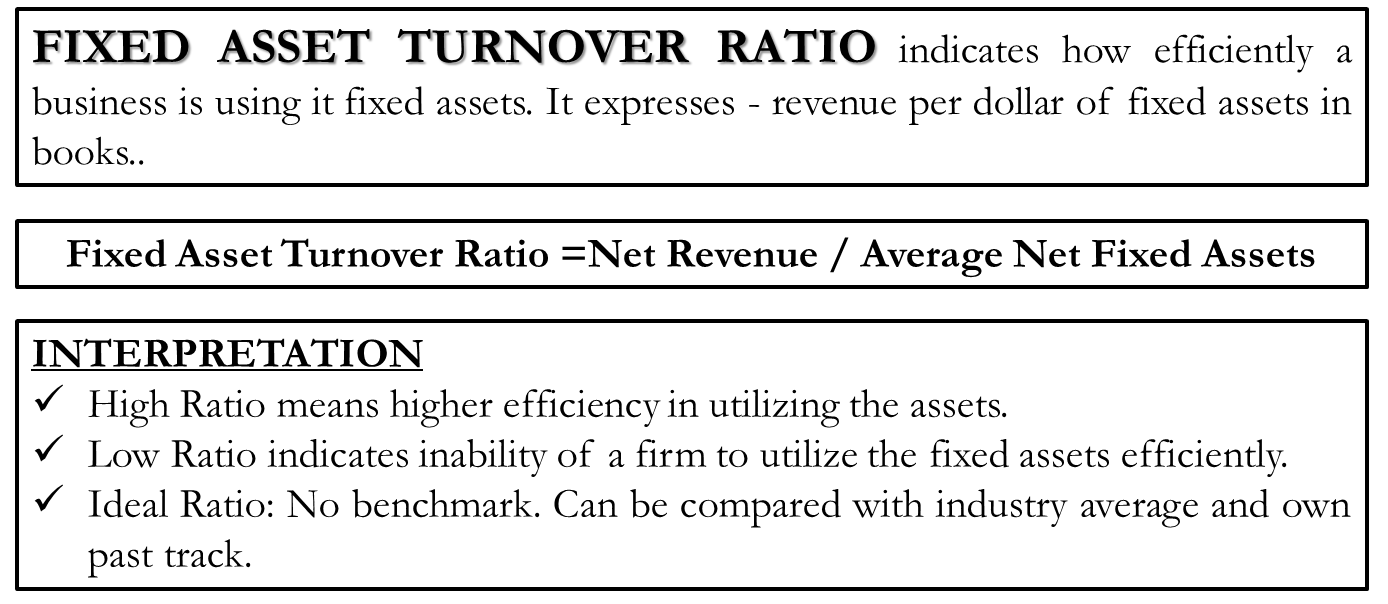

Fixed Asset Turnover Definition Formula Interpretation Analysis

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio